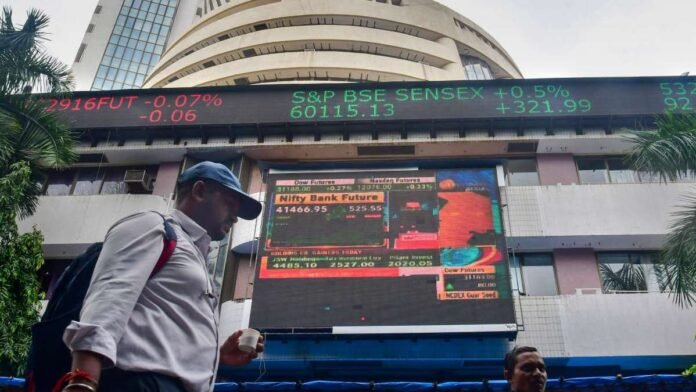

After investors earned profits on Monday, the Sensex and Nifty climbed. Nifty FMCG and Nifty Oil & Gas gained, but other Nifty sectors indices fell. With Nifty support at 21,320 and resistance at 21,500, analysts expect domestic markets to remain positive.

On Tuesday morning, the Sensex rose 254.11 points to 71,569.20 while the Nifty rose 61.35 points to 21,480. After a record gain last week and a lackluster Asian market, investors took profits on Monday, lowering major equity indices Sensex and Nifty.

Nifty Bank, Financial Services, and IT were down. Early increases were seen in Nifty FMCG and Nifty Oil & Gas.

The top five Nifty 50 equities were Apollo Hospitals, Nestle India, Tata Consumer Products, ONGC, and Coal India. Hero MotoCorp, TCS, M&M, Bajaj Finserv, and Hindalco led losses.

After the global slowdown, heavyweight stocks corrected, but analysts still see a bright future for domestic markets. After BJP’s electoral victories in key states, Indian markets rallied this month. Good macroeconomic data, aside for inflation, has boosted Dalal Street mood.

Investors are optimistic due to the US Federal Reserve’s policy position and speech, which suggests rate reduction in early 2024. Foreign investors are investing heavily in the domestic market.

Nifty should open with support at 21,320 and resistance at 21,500, according to analysts. Indian markets are predicted to consolidate between 21,200 and 21,500, thus traders should purchase on dips with a stop loss of 21,200. Long-term investors should keep their trailing stop loss near 21,200 to anticipate market changes.

Conclusion

After investors took profits on Monday, the Sensex and Nifty indices rose early Tuesday. Nifty Bank, Financial Services, and IT were down. Both Nifty FMCG and Nifty Oil & Gas gained. The top five Nifty 50 equities were Apollo Hospitals, Nestle India, Tata Consumer Products, ONGC, and Coal India. With strong gains this month and encouraging macroeconomic data, analysts remain optimistic about local markets. Investors are also encouraged by the US Federal Reserve’s policy stance and comments, which suggests early 2024 rate decreases. Indian markets are predicted to stabilize between 21,200 and 21,500, therefore buy on dips with a stop loss of 21,200.