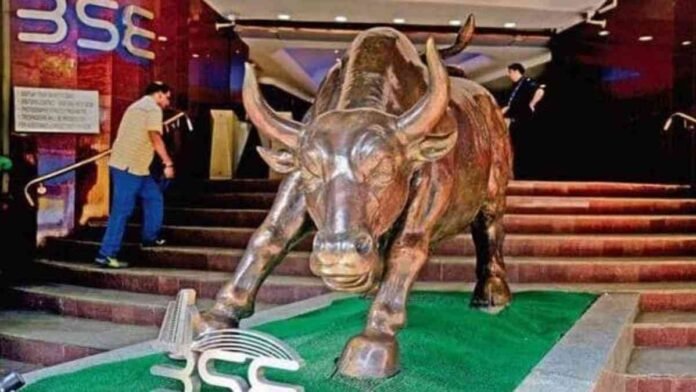

Share Market Today: The Sensex and Nifty set new highs on Thursday despite good inflation statistics from the United States. Investors hope this to give the Fed more reason to halt further rate rises.

The Sensex has surpassed the psychological level of 66,000, while the Nifty is trading over 19,500.

Quarterly earnings from heavyweights also had a role, with TCS among the largest gainers and HCL Tech among the biggest losers in early trade.

Retail inflation in India, which had been slowly declining for four months, jumped to a higher-than-expected 4.81% in June, owing to increased food and vegetable costs. Retail inflation in June remained within the central bank’s top tolerance zone of 6%, but over the medium-term aim of 4%.

Meanwhile, Wall Street equities rose on Wednesday, while the dollar and Treasury rates fell, after new US inflation data revealed a slowing in the seemingly unstoppable climb in consumer prices. CPI increased by 3.0% year on year through June, down from 4.0% in May and the weakest year on year increase since March 2021.

Conclusion The Sensex and Nifty reached new highs on Thursday, despite positive US inflation statistics. Investors hope this will give the Fed more reason to halt rate rises. The Sensex has surpassed the psychological level of 66,000, while the Nifty is trading over 19,500. Heavyweights like TCS and HCL Tech contributed to the gains.

Retail inflation in India reached a higher-than-expected 4.81% in June due to increased food and vegetable costs. Wall Street equities rose, while the dollar and Treasury rates fell due to US inflation data showing a slowing in consumer price increases.