Adani Group has taken another step towards regaining investor trust by repaying this debt. According to previous reports, Adani Group may sell its 4 to 5% interest in Ambuja Cements Ltd to repay the debt.

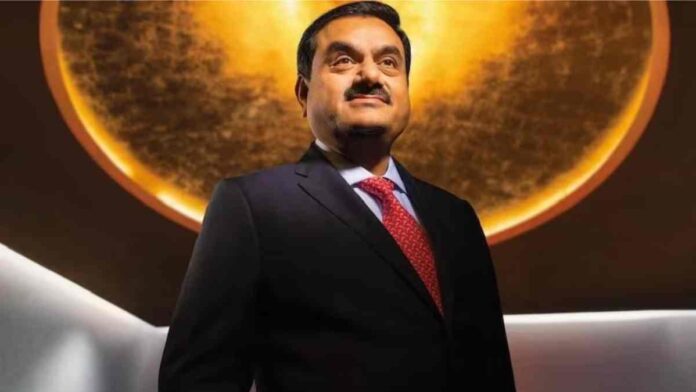

The American research company Hindenburg’s influence on the Gautam Adani-led Adani Group is rapidly dwindling, and the group is also taking substantial efforts one after the other to recover the faith of its investors. Adani Group has returned the $ 2.65 billion debt ahead of schedule. It also includes the repayment of $500 million from the loan used to acquire Ambuja Cement.

Adani Group made a statement in this respect on Sunday, stating that in order to regain the faith of investors, we have returned the $ 2.65 billion loan ahead of schedule. The deadline was March 31, 2023, but payment was already completed.

According to the statement, the $ 2.15 billion loan was obtained by pledging stocks in the group’s listed firms, while the $ 500 million loan was obtained for the acquisition of Ambuja Cement.

Adani Group, the cement industry’s second largest player, said that the promoters have already invested $ 2.6 billion in the overall acquisition value of Ambuja Cement and ACC Cement, which is $ 6.6 billion. Importantly, the Gautam Adani-led group completed the $10.5 billion acquisition of major Indian cement manufacturers Ambuja Cements and ACC in 2022. As a result, it is now the country’s second largest cement producer.

Before, similar sources said that Adani Group might make a significant choice to return the debt. Adani Group can sell its 4 to 5% interest in Ambuja Cements Ltd under this agreement to alleviate debt. The shareholding is reported to be worth $450 million (Rs 3,680 crore).

Previously, Adani Group stated in a statement that it has returned the Rs 7,374 crore debt by surrendering shares in four of the group’s listed firms. Meanwhile, the amount of premature payment has been increased to $ 2.15 billion. Apart from that, a $ 500 million loan payment for the Ambuja transaction has been added to it. Nevertheless, the company has not disclosed the source of cash used to settle this massive debt.

Hindenburg’s study report was published on January 24, this year; from the very next day, there was a tsunami in the shares of Adani’s firms, and they had to suffer tremendous losses with each passing day. Yet, there has been a significant gain in Gautam Adani’s wealth during the previous ten days due to a high rise in company stocks. The shares have risen further following the US firm GQG Partners’ investment of Rs 15,446 crore in four Adani entities.