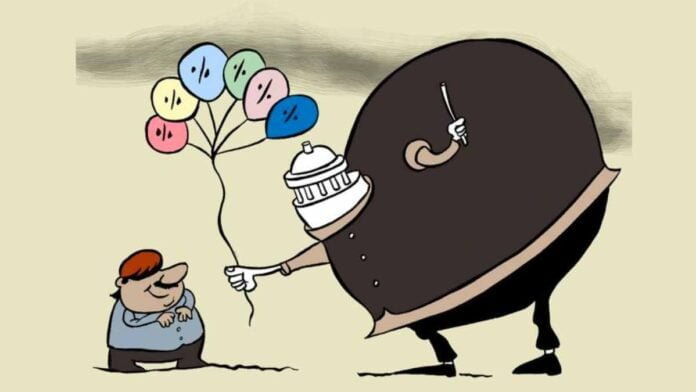

The interest rates on some small savings schemes have been raised for the second quarter in a row. Comparing the rates of interest with PSU banks, the three- and five-year time deposit rates of the post office are more favourable than those of the banks. The government has raised the interest rates on some smaller savings schemes.

For the second quarter in a row, the government has hiked interest rates on some modest savings plans.

Rates have been raised by 20 to 110 basis points (bps), and now range from 4.0 percent to 7.6 percent. Since May 2022, the Reserve Bank of India has raised the repo rate by 225 basis points (bps) with the goal of managing inflation.

The highest rate increases were found in one, two, and three-year fixed deposits. Rates at the shorter end are determined by the repo rate, and yields at the longer end are determined by market instruments, namely the g-sec.

Given the repo rate hike of 225 basis points, the largest rate increase was predicted in shorter-term instruments.

So, which instruments have become the most appealing as a result of the rate hike? The rates are normally about 7%, with the exception of the Senior Citizen’s Savings Scheme (SCSS), which has an 8% rate.

So, has SCSS grown in popularity? Sanjeev Govila, a Sebi-registered investment adviser and CEO of Hum Fauji Initiatives, a financial planning organisation, feels it has since it now offers 8%, which is especially useful for people in the zero or lower income tax categories.

The Public Provident Fund (PPF) rate has remained unchanged at 7.1%.

The Sukanya Samriddhi Yojana (SSY) rate is likewise fixed at 7.6%.

So, do these instruments lose their allure? PPF and SSY rates do not required to match repo rate rises that drive the shorter end because they are tied to long-term yields (the Gsec).

The 10-year G-Sec yield has fallen from 7.62 percent in June 2022 to 7.33 percent presently.

The fact that the PPF rate has not been increased makes it less appealing.

However, the tax advantages on interest, capital investment, and redemption proceeds make it a viable investment. Interest income produced on an investment created in a child’s name is taxed in the hands of the parent with the greater income (apart from a very modest limitation).

How do fixed deposit rates at the post office compare to bank rates? They are nearly identical, with a 0.1 percent to -0.3 percent difference.

A post office FD only pays out interest once a year, whereas banks provide several payout choices.

How do modest savings instruments now compare against debt funds? Small savings are also an appealing choice for investors in lower tax brackets, albeit debt mutual funds now provide somewhat higher rates to maturity than small saves, particularly in specific categories.

Debt mutual funds, like bank deposits, may be significantly easier to manage in terms of operations and service.

Many items are now available online, making management easier.

For latest Bollywood Update Follow us on Instagram & Watch on Youtube