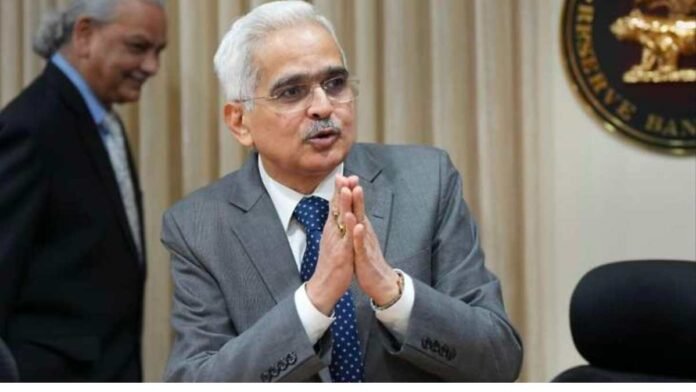

RBI governor, Shaktikanta Das, emphasized the importance of maintaining inflation rates at or around 4% to combat price increases. The RBI kept the repo rate at 6.5% for a second time, although providing solid advice amid a rate tightening cycle is still challenging.

On Thursday, RBI governor Shaktikanta Das said lowering India’s inflation is like finishing a half-done job. The RBI governor added that in order to effectively combat price increases, inflation rates must be kept continuously at or around 4%.

Retail inflation in India is currently higher than the optimum goal of 4%.

During the June 6–8 monetary policy meeting, Shaktikanta Das said, “While we’ve managed to keep inflation within the desired range (4-6%), our work is still halfway done. Our fight against inflation is not yet over.”

The RBI unanimously kept the repo rate at 6.5% for the second time. RBI loans to banks at the repo rate.

The national bank may have again slowed the essential loan fee due to the gradual decline in the expansion (which is currently at an 18-month low) and its genuine potential for another decline.

The RBI has hiked the repo rate by 250 basis points annually to battle inflation since May 2022, excluding April. Now 6.5 percent.

Shaktikanta Das says it is difficult to provide forward advice in a rate tightening cycle due to uncertainty.

The RBI governor said the bank would manage banking system liquidity with flexibility and agility.

He claimed the global economy was growing and uncertainty was decreasing.

Shaktikanta Das said, “However, headwinds to the global growth outlook persist.” Unabated, the geopolitical struggle is still going on. Although it is on the decline, headline inflation across all nations is still high and over their individual targets. Central banks are still on high alert and keeping an eye on the changing circumstances.

The RBI governor continued, noting that India’s inflation has declined, the outlook for the external sector has improved, and the balance sheets of banks and enterprises are solid and strong.

Conclusion:

RBI governor, Shaktikanta Das, has emphasized the importance of maintaining inflation rates at or around 4% to combat price increases. The RBI has kept the repo rate at 6.5% for the second time in a row, but challenges remain in providing firm guidance in a rate tightening cycle. India’s inflation has declined, and the external sector outlook is improving. The RBI has raised the repo rate by 250 basis points annually since May 2022, but the current uncertainty makes it difficult to provide firm guidance on future course of action in a rate tightening cycle. The global economy has maintained its growth momentum, but headwinds to the global growth outlook persist.

Central banks are on high alert and monitoring changing circumstances. India’s inflation has declined, and the outlook for the external sector has improved, with banks and enterprises’ balance sheets solid and strong.