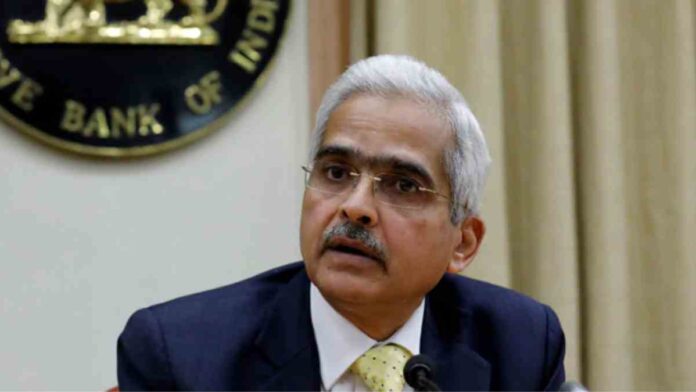

Shaktikanta Das, Governor of the Reserve Bank of India, stated that the G20 must deliver climate change money to the most vulnerable countries on a war footing.

Shaktikanta Das, Governor of the Reserve Bank of India, has warned banks against any accumulation of asset-liability mismatches, stating that both are damaging to financial stability, and implying that the existing crisis in the US banking system appears to be the result of such mismatches.

On Friday, the Governor delivered the annual KP Hormis (Federal Bank founder) memorial speech in Kochi, and was quick to recognise and ensure that the domestic financial system is solid and so that the most horrible of the inflation is in fact behind us.

The RBI Governor focused the most of his address on India’s G20 presidency, and in that context, he advocated for greater coordinated efforts by the world’s 20 largest economies to assist nations facing significant external debt problems as a result of the US dollar’s increase. He stated that the organisation must offer climate change money to the majority of afflicted nations on a war footing.

Concerning the US baking crisis, in which two mid-sized banks (Silicon Valley Bank and First Republic Bank) with over $200 billion in balance sheets each went bankrupt last week, he stated that the ongoing crisis emphasises the importance of robust regulations that focus on sustainable growth rather than excessive build-up on either the asset or liability side.

Mr Das, who would not name the US bank, stated that one of them appeared to have unmanageable deposits in excess of their assets side company. Mr Das, an outspoken critic of private digital currencies, stated that the recent US banking crisis plainly demonstrates the hazards of private crypto currencies to the financial system.