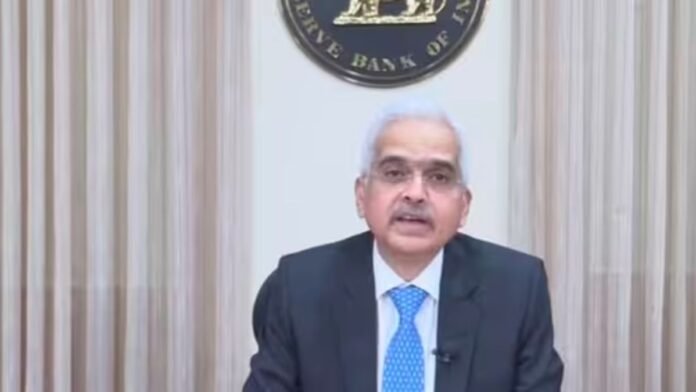

On Thursday’s Monetary Policy Committee (MPC) announcements, it is widely anticipated that Governor Shaktikanta Das of the Reserve Bank of India (RBI) will maintain the current repo rate at 6.50 per cent and pursue his strategy of withdrawing accommodation gradually. A report by the State Bank of India has hinted at a possible delay due to seasonal factors reducing inflationary pressures.

The SBI report indicates that the Reserve Bank of India is unlikely to shift from withdrawing accommodation towards neutrality; consequently, no major shift in approach can be expected. This expectation aligns with a poll conducted with 75 economists by Reuters that forecasted keeping repo rates steady at 6.50 per cent until at least the first quarter of 2024 and that any next move (if any) may include rate reduction in 2024’s second quarter.

Governor Shaktikanta Das had earlier decided, with unanimous agreement from his committee members, to keep repo rates unchanged at 6.50 per cent in a June policy meeting, after initiating rate hikes totalling 250 basis points beginning May 2022 and intended to contain inflation. Repo rates also remained constant during the April meeting.

Economic experts generally predict that the Reserve Bank of India (RBI) will maintain its repo rate at 6.50 per cent at its August 10 policy meeting, with some anticipating it could even drop to 6.25 per cent according to some forecasts. This cautious stance aligns with ongoing efforts to curb inflation while supporting economic recovery efforts.