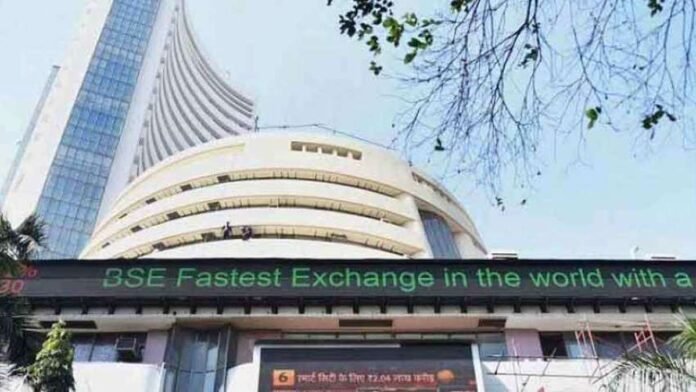

The BSE Sensex and NSE Nifty rallied to new record highs above 70,000. IndusInd, UltraCemco, Kotak, Tata Motors, HCLTech, and Tata Steel led gains. The overall markets rose 0.3%, but Nifty Pharma fell 1%.

In early trade on Monday, the BSE Sensex crossed the all-time high of 70,000 while the Nifty50 rose past 21,000. The BSE Sensex rose 117 points to 69,942 at 9:55 am, while the NSE Nifty50 rose 25 points to 20,994.

A record early rise saw the benchmark Sensex reach 70,000 for the first time. The Sensex and Nifty struck new lifetime highs after a strong comeback.

IndusInd Bank, UltraCemco, Kotak Bank, Tata Motors, HCLTech, and Tata Steel led the 30-share Sensex. Asian Paints, Axis Bank, Sun Pharma, Wipro, HUL, and Bajaj Finserv lost. Dr Reddy’s fell 6% after receiving Form 483 with 3 observations from the US FDA for its Hyderabad R&D facility.

In the broader markets, the BSE MidCap index rose 0.3% and the SmallCap index 0.6%. However, Nifty Pharma fell 1%. FMCG, Realty, and IT indices gained.

Last Friday, the BSE Sensex closed at 69,825.60, up almost 300 points. The NSE Nifty50 reached a record high of 21,006.10 and ended slightly lower at 20,972.15. Early trade is up, indicating a bullish market and a good week.

Due to regulatory changes, investors are watching sectors movements and Dr Reddy’s stock. Positive momentum, especially in mid- and small-caps, shows market confidence. Market participants expect more information about the sustainability of these record levels during the day.

Conclusion

On Monday, the BSE Sensex and NSE Nifty rallied beyond 70,000 and 21,000 in early trade. The benchmark Sensex and Nifty rose to record highs. IndusInd, UltraCemco, Kotak, Tata Motors, HCLTech, and Tata Steel led gains. Asian Paints, Axis Bank, Sun Pharma, Wipro, HUL, and Bajaj Finserv lost. After receiving Form 483 with 3 observations from the US FDA for its Hyderabad R&D facility, Dr Reddy’s fell 6%. The BSE MidCap index rose 0.3% and SmallCap 0.6%. The Nifty Pharma sector fell 1%. Market optimism and a great week start are indicated by the rise. Following regulatory changes, investors are watching sectoral stocks like Dr Reddy’s.