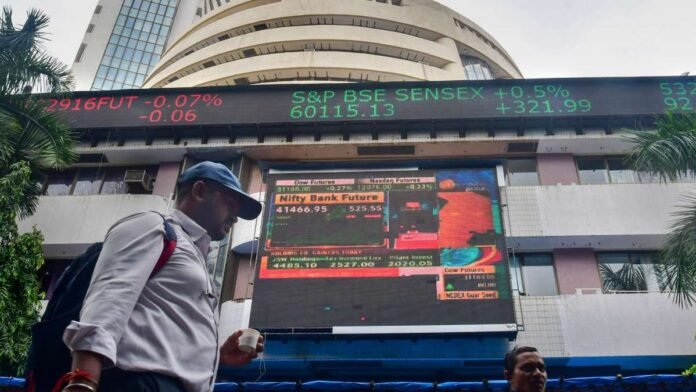

The stock market fell in early trade on December 21, Thursday, due to COVID-19 worries. The Sensex fell 585.92 points and the Nifty 173.35 points. Market volatility drivers and the economy are being examined by analysts.

The Sensex fell 585.92 points to 69,920.39 in early trading. The Nifty fell 173.35 points to 20,976.80. Both benchmark indices fell due to market dynamics such global economic trends, geopolitical developments, and domestic economic indicators. Investors are attentively watching market fluctuations throughout the trading period.

This early trade slowdown compels researchers to examine the economy and market drivers.

Benchmark stock market indices opened sluggish on Thursday as investors booked profits on rising COVID-19 cases.

The S&P BSE Sensex down 0.58% to 70,090.11 at 9:16 am, while the NSE Nifty 50 fell 0.62% to 21,022.75.

Smallcaps and midcaps fell in broad market indices due to increased volatility. Nifty Bank and Nifty Financial Services fell almost 0.8% early on. Nifty Media was the sectoral index that gained the most, nearly 2%.

Power Grid, Adani Ports, Adani Enterprises, LTIM, and ONGC had strong Nifty 50 gains. The biggest drags were Axis Bank, Bajaj-Auto, Cipla, LT, and Sun Pharma.

After reaching record highs in early trade, Wednesday’s surprising slump, which saw the Sensex plummet 1.3% and Nifty tumble 1.4% before closing bell, was one of the worst for both benchmark indices.

Market observers relate the recent market momentum shift to the rise of Covid cases in India, the US, and the UK, prompting uncertainty and profit booking.

Conclusion

Early trade saw the Sensex and Nifty fall. The drop reflects global, geopolitical, and domestic economic trends. The rise in COVID-19 instances caused market volatility, forcing profit booking. The S&P BSE Sensex fell 0.58% and the NSE Nifty 50 0.62%. The rise of Covid cases in India, the US, and the UK has caused uncertainty and profit booking, shifting the market’s trend.