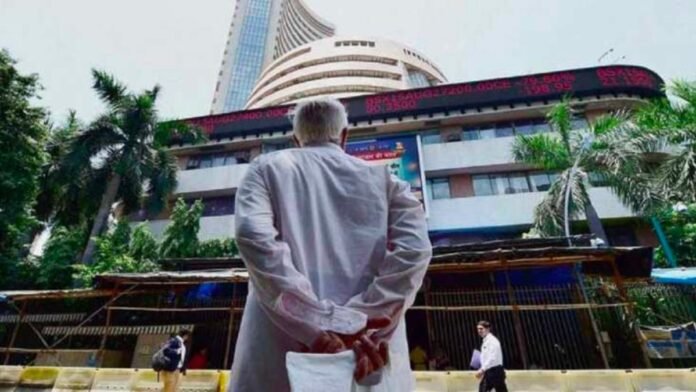

Stock Market Today: In the pre-opening session on Monday, the benchmark indices are trading down due to conflicting global indications. The 30-share BSE Sensex decreased by 136.61 points to 65,872.54 in value. To 19,634.55, the Nifty dropped 39.7 points.

The Sensex companies that lagged behind the rest included Larsen & Toubro, Axis Bank, ITC, Infosys, Tata Consultancy Services, Reliance Industries, Hindustan Unilever, and IndusInd Bank. Gainers were Asian Paints, Maruti, Bajaj Finance, and Bajaj Finserv.

Seoul, Shanghai, and Hong Kong were trading in the red on Asian markets, while Tokyo was trading in the black. The US stock markets fell on Friday.

Benchmark Brent crude increased 0.21% to USD 93.47 per barrel.

According to exchange statistics, foreign institutional investors (FIIs) sold shares of stock on Friday totaling Rs 1,326.74 crore. In the first three weeks of September, FPIs pulled out about Rs 10,000 crore from Indian stocks.

A tranquil equities market and a strong US dollar relative to its major rivals pushed the rupee down 16 paise to 83.10 against the dollar in early trade on Monday.

The native currency at the interbank foreign exchange opened weakly at 83.04 and fell as low as 83.10 versus the dollar, losing 16 paise from its previous finish. The rupee increased 19 paise on Friday to end the day at 82.94 against the dollar.

The increase in the rupee was ascribed by analysts to JP Morgan’s statement that it would begin including Indian government bonds in its global bond index in June 2024. This move is anticipated to result in USD 25–30 billion of new investments into the Indian debt market.

Conclusion:-

The BSE Sensex and Nifty indices experienced a decline due to global uncertainties. The Sensex slid 136.61 points to 65,872.54 and 19,634.55. Sensex businesses that trailed included Larsen & Toubro, Axis Bank, ITC, Infosys, TCS, Reliance Industries, Hindustan Unilever, and IndusInd Bank. However, Asian Paints, Maruti, Bajaj Finance, and Bajaj Finserv gained. Asian markets were trading in red, while Tokyo was in black. The US stock markets also fell on Friday. Foreign institutional investors sold shares of stock, totaling Rs 1,326.74 crore. The rupee lost 16 paise against the US dollar, but increased 19 paise on Friday. Analysts attribute this increase to JP Morgan’s announcement to include Indian government bonds in its global bond index in June 2024.