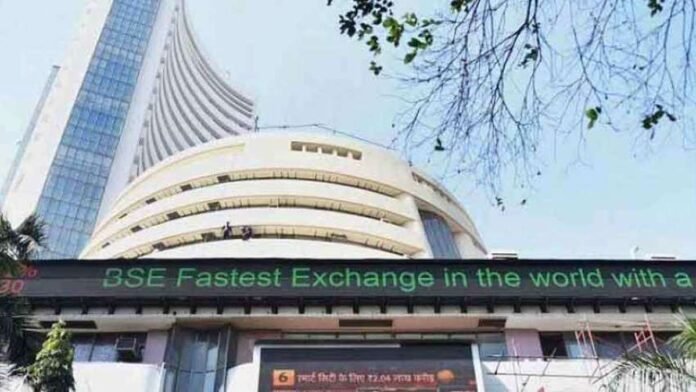

The BSE Sensex and Nifty rose while the rupee remained steady. Asian markets held up, with Wall Street tech companies rising.

BSE Sensex rose 30.99 points to 71,386.21 on Tuesday, while Nifty rose 31.85 points to 21,544.85.

At 83.11 against the US dollar, the rupee held steady from 83.13 the previous session.

Asian markets showed resilience as numerous indices rose after Wall Street tech stocks rose. US inflation data, which affects Federal Reserve interest rate decisions, is closely watched by global markets.

Saudi Arabia’s price decrease and signs of a weaker physical market drove oil prices down to their lowest level in a month. After hitting a three-week low, gold prices rose on Tuesday as the dollar fell.

On Monday, FIIs bought 160.30 million Indian shares and domestic investors bought 1.56 billion. FPI buying in Indian shares hit a record high in December.

Retail inflation, industrial production statistics, and TCS, Infosys, and Wipro earnings reports later this week remain top priorities for investors.

Conclusion

The BSE Sensex and Nifty climbed on Tuesday as the rupee held firm versus the US dollar. Asian markets survived Wall Street tech stock spikes. US inflation data influences Federal Reserve interest rate decisions, therefore global investors watch it. Oil fell, but gold rose after a three-week low. In December, foreign institutional investors acquired Indian securities worth Rs 160.30 million and Rs 1.56 billion, a record.