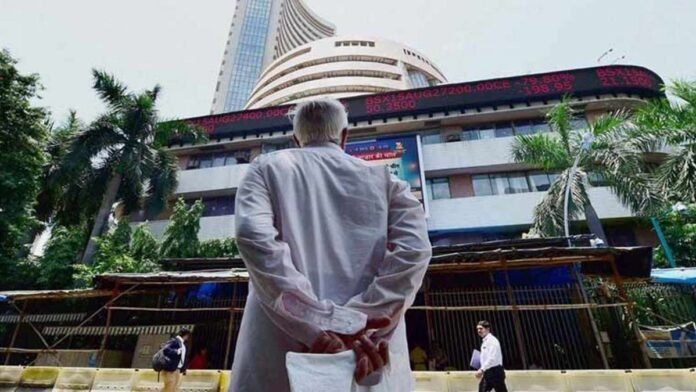

Nov. 20’s early trade saw equity benchmark indices fall due to poor Asian markets and international investment outflows. The Nifty fell 15.3 points and the BSE Sensex 97.18 points…

Equity benchmark indices fell early Monday on poor Asian markets and continued foreign capital withdrawals. Early trade saw the 30-share BSE Sensex fall 97.18 points to 65,697.55. Nifty fell 15.3 points to 19,716.50.

Sensex laggards were Mahindra & Mahindra, Axis Bank, Kotak Mahindra Bank, Larsen & Toubro, Bajaj Finance, and UltraTech Cement. HCL Technologies, NTPC, Tech Mahindra, Infosys, SBI, and Power Grid gained.

Seoul, Shanghai, and Hong Kong rose while Tokyo fell. The US markets gained slightly Friday.

The recent rally in the mother market US prompted by falling bond yields makes the market slightly positive for the rally in India. Like cricket, the market has setbacks, but the long-term trend matters “according to Geojit Financial Services Chief Investment Strategist V K Vijayakumar.

Brent crude rose 0.69 percent to USD 81.17 per barrel. FIIs sold Rs 477.76 crore in stocks on Friday, according to market data.

Rupee/dollar

As local equities fell, the rupee traded in a limited range against the US dollar in early trade on Monday.

Forex traders claimed the rupee is rangebound due to foreign cash outflows and rising crude oil prices.

The local unit opened at 83.25 against the dollar at the interbank foreign exchange and ranged from 83.23 to 83.27. The rupee hit 83.26 per dollar on Friday.

The dollar index, which compares the dollar to six currencies, fell 0.36 percent to 103.54. Brent crude prices increased 0.73 percent to USD 81.20 per barrel.

Conclusion

Indian equity benchmark indexes fell early Monday due to unfavorable Asian market trends and foreign investment outflows. BSE Sensex down 97.18 points to 65,697.55; Nifty fell 15.3 points to 19,716.50. Mahindra & Mahindra, Axis Bank, Kotak Mahindra, Larsen & Toubro, Bajaj Finance, and UltraTech Cement lagged. Power Grid, HCL Technologies, NTPC, Tech Mahindra, Infosys, and State Bank of India gained. Seoul, Shanghai, Hong Kong, and Tokyo traded green, while Tokyo traded down.

The US markets gained slightly Friday. Since US bond yields are falling, the market is marginally more favorable for India’s surge. The rupee traded in a limited range against the US dollar as domestic shares fell. Brent crude futures increased 0.73% to USD 81.20 per barrel, while the dollar index fell 0.36% to 103.54.