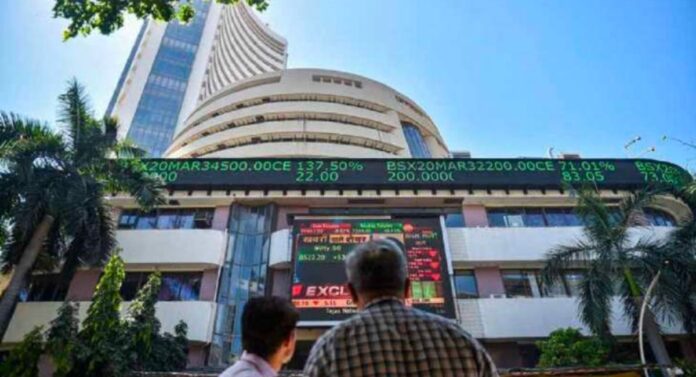

Equity benchmark indexes rose in early trade on Tuesday as they continued their surge for a third day in a row due to positive domestic macroeconomic data. The benchmark Sensex on the BSE increased 119.17 points in early trade to reach 65,747.31. To 19,567.95, the Nifty increased by 39.15 points.

Titan, Sun Pharma, Larsen & Toubro, ITC, Bajaj Finance, Power Grid, Nestle, and Tata Motors were the top gainers from the Sensex pack. Among the backward companies were JSW Steel, Bharti Airtel, UltraTech Cement, HCL Technologies, and NTPC.

How did the US and Asian markets perform?

Seoul, Tokyo, Shanghai, and Hong Kong were trading negatively on Asian markets. On Monday, the US stock markets were closed. According to Shrikant Chouhan, Head of Research (Retail) at Kotak Securities Ltd., the attitude has changed for investors after a recent run of solid macroeconomic figures, while worries over a bad monsoon will continue to weigh in the near term.

According to a survey issued on Friday, manufacturing activities in India picked up in August as new orders and production climbed at the fastest rates in nearly three years. On the strength of increased compliance and decreased evasion, GST revenues increased by 11% to over Rs 1.59 lakh crore in August, and analysts anticipate continued growth throughout the approaching holiday season.

Domestic passenger car sales set a record in August, driven by Maruti Suzuki, which had its highest-ever monthly dispatches as a result of holiday demand and the sustained robust offtake of SUVs. Benchmark Brent crude for world oil prices fell 0.07 percent to USD 88.94 per barrel.

According to exchange statistics, foreign institutional investors (FIIs) sold shares of stock on Monday totaling Rs 3,367.67 crore. The BSE benchmark increased 240.98 points or 0.37 percent on Monday to close at 65,628. The Nifty finished at 19,528.80 up 93.50 points, or 0.48 percent.

Dollar-Rupee exchange rate drops by 13 paise.

As foreign investors took their money out of local markets and crude oil prices climbed, the rupee lost 13 paise to 82.84 versus the US dollar in early trade on Tuesday. Forex traders said rising equities market sentiment did not help the rupee, which is under pressure from the dollar.

The native currency at the interbank foreign exchange started off at 82.78 before falling to 82.84 versus the dollar, losing 13 paise from its previous finish. The rupee’s value versus the dollar had been decided at 82.71 on Monday.

Conclusion:-

Equity benchmark indexes rose for a third day in a row due to positive domestic macroeconomic data. The BSE benchmark Sensex increased 119.17 points to reach 65,747.31, while the Nifty increased by 39.15 points. Top gainers included Titan, Sun Pharma, Larsen & Toubro, ITC, Bajaj Finance, Power Grid, Nestle, and Tata Motors. Meanwhile, Asian markets were trading negatively, with the US stock markets closed on Monday. Manufacturing activities in India increased in August, with new orders and production climbing at the fastest rates in nearly three years. GST revenues increased by 11% to over Rs 1.59 lakh crore, and domestic passenger car sales set a record. The dollar-Rupee exchange rate dropped by 13 paise, with the rupee losing 13 paise to 82.84 versus the US dollar in early trade. The strong sentiment in the equities markets has not helped the Indian rupee, which is under pressure from the strong dollar.