Tredence, a data science startup, has secured funding of $175 million. Among other things, the company intends to utilise the funds to broaden its client base.

A San-Jose based supplier of data science and artificial intelligence (AI) services, Tredence, has secured $175 million in a Series B fundraising round headed by Advent International, with current investor Chicago Pacific Founders participating.

According to a release, the San Jose-based firm intends to utilise the investment to continue its growing pace, develop vertical skills, and extend its client base. With the $175 million investment, Advent will acquire a minority ownership in Tredence.

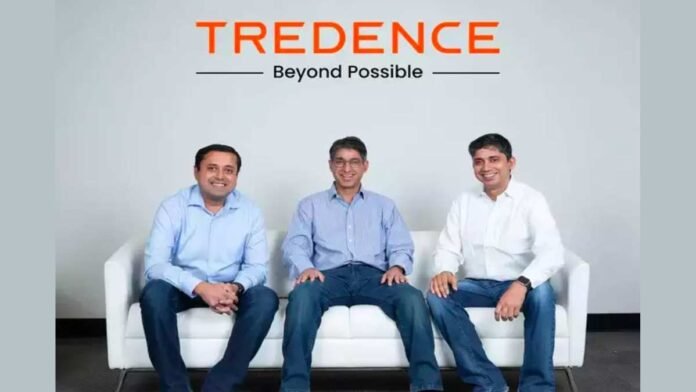

Tredence was formed in 2013 by Shub Bhowmick, Sumit Mehra, and Shashank Dubey with the goal of bridging the gap between insight delivery and value realisation by providing clients with a distinct approach to data and analytics through tailor-made solutions.

Co-founder and CEO Bhowmick, stated, “Tredence was formed to assist customers in solving some of the most challenging issues across sectors via pragmatic innovation and ongoing experimentation. CPF (Chicago Pacific Founders) has been a valuable partner over the previous three years, and we are pleased to be joined on this adventure by Advent.”

Tredence has nearly 1,800 employees with offices in San Jose, Foster City, Chicago, London, Toronto, and Bangalore, with clients in retail, consumer packaged goods, high-tech, telecom, healthcare, travel, and other industries.

In 2021, the firm established a vertical AI go-to-market approach to tackle industry challenges through the combination of strong data science skills and commercial context.

The company’s vertical AI approach will centre on ATOM.AI, a comprehensive accelerator environment that helps organisations from design to experience to value.

Advent International is a worldwide private equity firm that focuses on company buyouts in Western and Central Europe, North America, Latin America, and Asia.

Encora, CI&T, NielsenIQ, Neoris, Sophos Solutions, Aareon, Canvia, and QuEST Global Services are among the most recent investments in IT and information services.

Tredence has so far secured $30 million in private equity investment.

Shweta Jalan, Managing Partner of Advent International in India, said, “Data analytics is an intriguing industry of digital IT services with secular growth. The practise is propelled by the increase in data collected and recorded globally, lower processing and storage costs, and the possibility for organisations to tap into useful insights to achieve competitive advantage.”

For latest Bollywood Update Follow us on Instagram & Watch on Youtube